24 January 2023 (UPDATED); Kuala Lumpur Malaysia, YU KUAN CHON, Chairman of the board of Rapid Synergy Bhd, deceived its Shareholders with Material Fraudulent Misrepresentation in the 2021 Annual Report. The company intentionally failed to report related parties of the Controlling Shareholders to avoid further reprimands from Malaysia Security Commission and a Mandatory takeover offer.

The Group of declared YU Syndicate members “officially” reported as Related Parties with YU KUAN CHON and his brother YU KUAN HUAT cannot collectively exceed 33% of the outstanding shares of Rapid Synergy Bhd without the Group tendering an offer to buy from all shareholders. It is the law that protects minority shareholders from abuses by self-serving controlling shareholders.

Breach of Section 218 (2) of the Capital Markets and Services Act 2007 and Paragraph 4.01(a) of the Rules on Take-overs, Mergers, and Compulsory Acquisitions” by “failure to undertake a mandatory takeover offer on Rapid Synergy Berhad pursuant to the Group increasing their collective shareholdings to above 33%.”

In an earlier reprimand by the Securities Commission of Malaysia dated 28 September 2021, the group of related parties exceeding 33% on 29 April 2019 was identified specifically as:

- Yu Kuan Chon

- Chan Sow Keng

- Yu Kuan Huat

- Teh Nai Sim

- Yu Chong Choo

- Yu Choon Geok

- Ng Choon Hua

The 2021 Annual Report of Rapid Synergy Disclosed that on 31 March 2022, YU KUAN CHON has a direct and indirect interest of 26,103,110 Shares totaling 24.42%. His Brother YU KUAN HUAT holds another direct and indirect interest of 4,250,550 Shares totaling 3.98%

This disclosure is Material and Fraudulent Misrepresentation. Members of the Group know that CHAN WENG FUI, pictured above, is a Related Party and belongs to the Related Party list. He holds at least 14% of Rapid Synergy and is an employee of YU KUAN HUAT.

Bursa Malaysia defines a “Related Party” as follows:

(a) in relation to a corporation, means a director, major shareholder, or “person connected” with such director or major shareholder;

A “person connected” is defined as follows:

(iv) a person who is accustomed or under an obligation, whether formal or informal, to act in accordance with the directions, instructions, or wishes of the said Person;

(v) a person in accordance with whose directions, instructions or wishes the said Person is accustomed or is under an obligation, whether formal or informal, to act;

The 2021 Annual Report shows that in the top 30 shareholder list, CHAN WENG FUI is the owner of at least 15,756,300 shares. This is another 14.7397%

That means between YU KUAN CHON and CHAN WENG FUI, the 2 own 39.1597%. Well above the 33% threshold of the mandatory takeover offer requirement. This does not include shares that are owned by other related parties previously listed such as YU KUAN HUAT.

CHAN WENG FUI aka “DANIEL” has been and is currently listed as YNH’s Property Bhd’s main Investor Relations contact, together with “James” Ngio Hua Jian. Both are long-time Employees of YNH Property Bhd and are Related parties to YU KUAN CHON and YU KUAN HUAT.

It is well known that 2 Controlling Shareholders of RAPID SYNERGY, YU KUAN CHON, and his Brother YU KUAN HUAT are also controlling shareholders of YNH Properties Bhd. That makes CHAN WENG FUI a direct Employee and “Person Connected” to the YU Brothers. It is clear that CHAN WENG FUI is a Related Party to Both YU KUAN CHON and YU KUAN HUAT.

Some news media articles refer to CHAN WENG FUI as a “close associate” of YU KUAN CHON. People familiar with the relationship refer to him as YU KUAN CHON’s right-hand man, trusted proxy, and general problem solver. Others close to the matter have gone further and referred to him as YU KUAN CHON’s puppet.

Sources close to CHAN WENG FUI or Daniel, as often called, say he has been shopping for a Datukship with plans to exit from the shadows of the YU Syndicate when the time is right with grand plans to form his own dynasty.

The big question is, how does CHAN WENG FUI, a man with no history of business achievement or source of income other than from YU KUAN CHON, manage to purchase all those millions of shares of Rapid Synergy and YNH Property in such a short period of time. Where did the money come from?

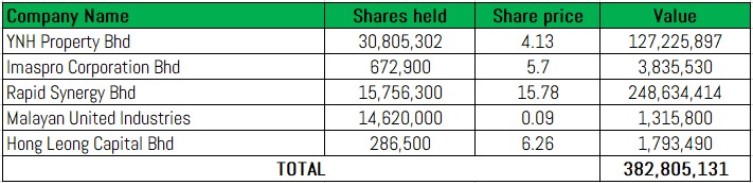

Today, CHAN WENG FUI’s public share portfolio is worth a staggering MYR 382 million, not bad for a management-level employee of YNH Property Bhd.

Proxy or not, CHAN WENG FUI clearly stipulates as a Related Party by merit of his employment by YNH Property Bhd. Any employee, especially senior management levels, is accustomed to and bound to follow the directions and instructions of the Chairman and Managing Director (YU KUAN CHON and YU KUAN HUAT).

Interestingly, we find no Bursa announcements about any of this, not even the fact that CHAN WENG FUI now is considered a substantial shareholder of Rapid Synergy Bhd, a fact warranting a separate Mandatory public disclosure.

This fact raises the question as to why all these Share movements are being kept under the radar. Is it that YU KUAN CHON is trying to avoid having to make a mandatory offer to all shareholders of Rapid Synergy for breaching the Rules on Takeovers, Mergers, and Compulsory Acquisitions?

YU KUAN CHON and his inner circle were recently reprimanded and fined by the Securities Commission Malaysia for “Breach of Section 218 (2) of the Capital Markets and Services Act 2007 and Paragraph 4.01(a) of the Rules on Take-overs, Mergers, and Compulsory Acquisitions” by “failure to undertake a mandatory takeover offer on Rapid Synergy Berhad pursuant to the Group increasing their collective shareholdings to above 33% on 29 April 2019.”

A Source close to the matter has recently leaked a trove of information that reveals some of the interworkings of the YU Syndicate. Additional disclosures and stories are to be forthcoming in the near future.

Minority Shareholders are clearly being disadvantaged according to the public records alone. One can only wonder what is hidden in the fine print, side letters, and internal documents that are not currently privy to the public and mandatory disclosures.

Information used in this story has been obtained primarily from public and corporate records and inside confidential sources close to the matter. This investigation is ongoing, and the facts and data will lead us to the truth. Stay tuned for more to come in the following weeks.

If you have information about the YU Syndicate, YHN, RAPID, or other related parties mentioned in this article, feel free to email us. If you are concerned about privacy, please use a new email account dedicated solely to this purpose. Contact us via the contact us links or by email ([email protected]). We welcome public assistance and will go to great lengths to protect our sources.