Kuala Lumpur: Malaysia and Singapore have escalated their more drawn-out term. Situating as regional hubs for green and maintainable finance. Making the giving of sustainability securities in Asean more energetic.

The Climate Bonds Initiative, which is upheld by HSBC, has dispatched the ASEAN Sustainable Finance State of the Market 2020. In which they uncovered that the locale’s manageable money market has kept up fast development regardless of the adverse consequence of COVID-19. Causing to notice the requirement for a maintainable financial recuperation.

As per the report, the Malaysian security bond and Sukuk market as of now remains at US $2.6 billion. Malaysian entities have issued an aggregate of 15 green bond, sukuk and advance arrangements, with six happening in 2019 and three out of 2020.

The principal ASEAN Green Sustainable and Responsible Investment Sukuk, one of the green deals, came out in the market in 2020. It was valued at RM260 million (US $61 m) and issued by leader energy. With the lead arranger being HSBC Amanah Malaysia. The report said, “The proceeds are to finance two solar photovoltaic power projects in Kedah. Which also marks Leader Energy’s debut project financing issuance in the ringgit denominated bond market.”

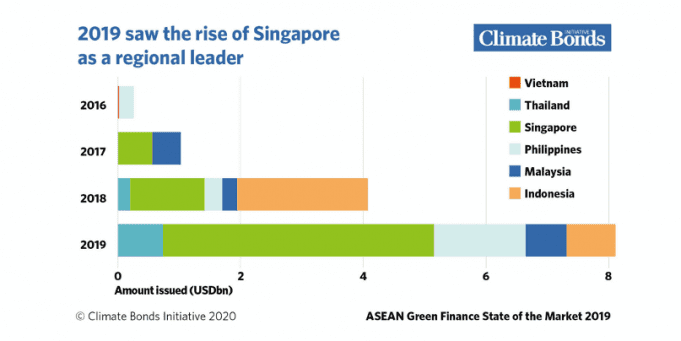

The report likewise featured key approach improvements that are expected to drive Asean’s Sustainable finance market. Like Malaysia’s Joint Committee on Climate Change, driven by Bank Negara Malaysia and Securities Commission Malaysia. The report also indicates that it will recognize the advancement of guidance records on the environment. Hazard management and situation examination as one of its needs in 2021. In the interim, the Asean Green, Social, and Sustainability (GSS) issuance arrived at a record high of US$12.1 billion out of 2020, from US$11.5 billion given in 2019. Since 2016, cumulative GSS issuance now remains at US $29.1 billion in ASEAN.

On the sector’s viewpoint, Sustainable finance is set to additionally support national recuperation and improvement plans to “build back better” as proposed by the report. The report added, “Singapore remained the leader of GSS issuance in 2020. Representing 53 per cent of the region’s issuance. Public sector issuance remains a driver to encourage private sector issuers to participate in the market. And ASEAN’s sovereign issuers’ club is set to expand. With planned sovereign green bond issuance already announced by Singapore and Vietnam. Malaysia, on the other hand, sees a future role as an international centre for sustainable Islamic finance and green sukuk.”

Furthermore, ASEAN markets are on the whole fostering a framework. To offer more prominent lucidity for sale to the market members and extending endeavours to improve definitions for reasonable speculations. Bernama – The advancement of different instruments. For instance, three sustainability-connected bonds and loans or exchange bonds, are additionally expected to meet the larger financing needs of Asean’s low carbon progress.

HSBC presently characterize sustainable finance as:

- Any type of monetary assistance that coordinates natural, social and administration measures into business or speculation choices.

- Financing and speculation exercises that help the UN Sustainable Development Goals (SDGs), specifically making a move to battle environmental change.